Stopping AI-Armed Authorized Fraud

Why 33N Invested in Acoru

After announcing the investment in Acoru in the last weeks, we took time to write on why we invested and find ourselves honoured to be supporting the Acoru team.

Acoru, a Madrid-based startup, is pioneering voluntary fraud detection and money mule prevention. In the last few years these threats have increased with the democratization of AI and thus this is a natural extension of our mission of looking for technologies that redefine how cybersecurity and infrastructure software address emerging threats.

Our relationship with Acoru began before it’s inception having known the founders from previous ventures. We followed Acoru from early on and since the early beginnings their vision has only strenghtened: to enable banks and financial institutions to detect and prevent fraud before any transaction occurs.

The Growing Threat of AI-Powered Fraud

Generative AI is transforming the fraud landscape. Deepfakes, voice cloning, and large-scale social engineering attacks are fueling a global fraud crisis — with losses near $500 billion annually.

Traditional fraud detection systems, designed a decade ago, are reactive and insufficient for today’s authorized push payment scams and AI-automated mule networks.

Regulatory Tailwinds Driving Adoption

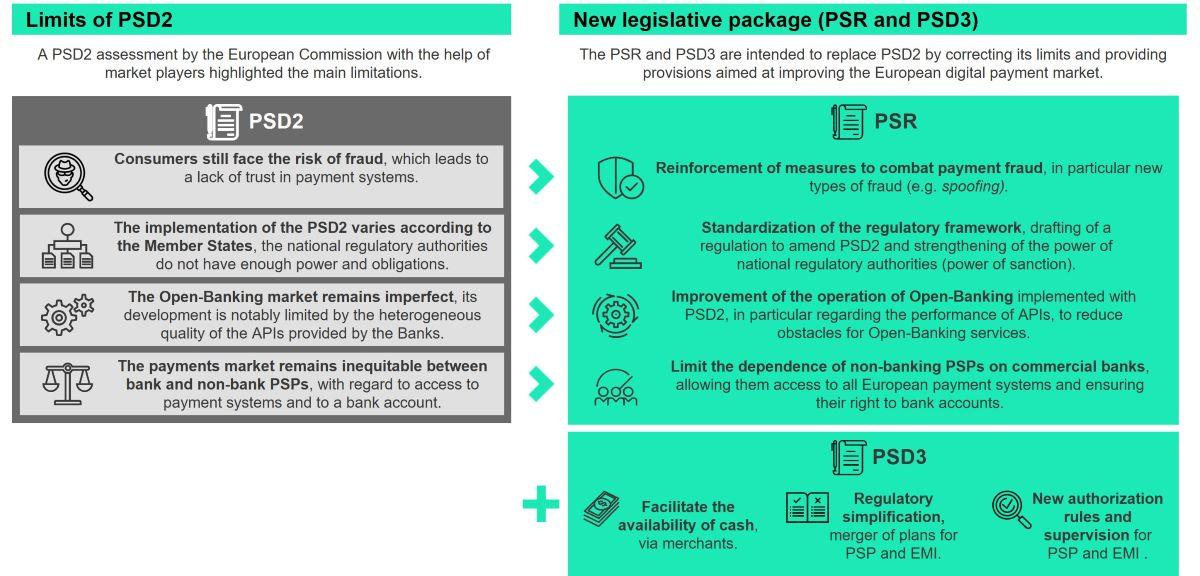

With regulators in the EU and UK tightening fraud reimbursement and reporting obligations, the pressure on banks to act preemptively is stronger than ever. Acoru’s system enables customers to remain compliant while reducing financial and reputational risk.

It positions the company at the intersection of Cybersecurity, AI and Compliance — a juncture we believe will define the next era of digital trust infrastructure.

Distinctive technology proposition

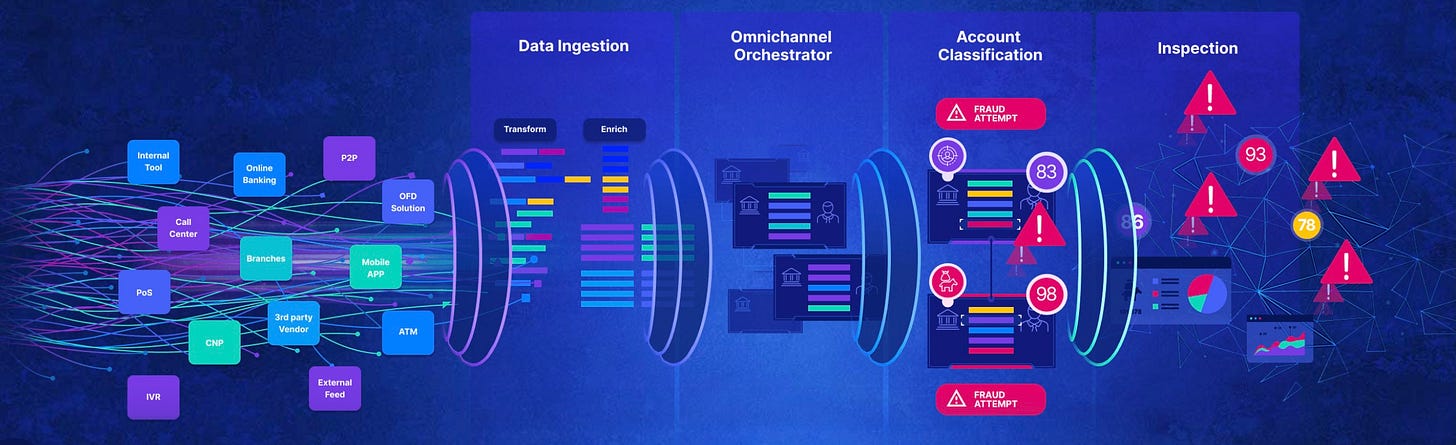

Acoru’s Voluntary Fraud Prevention Platform continuously analyzes millions of data points across connected accounts to identify criminal intent before it manifests in a transaction.

Key capabilities include:

Fraud Prediction: Predicts future scams, money mules, and compromised accounts using behavior and intent models.

Cross-channel Intelligence: Monitors both target and related accounts to reveal complex patterns

Consortium Model: Allows participating banks to share anonymized classifications through a secure, centralized network to build collective resilience.

This model provides real-time, AI-enhanced insight into fraud risk while supporting compliance with EU and UK mandates for shared scam reimbursement frameworks (e.g. PS23/4, PSD3).

Experienced leadership with global ambition

Acoru was founded in 2023 by Pablo de la Riva Ferrezuelo and David Morán, serial entrepreneurs behind Buguroo / Revelock (sold to Feedzai, 2021), who are recognized experts in cybersecurity and fraud prevention with proven industry credibility.

The team has grown to over 30 professionals across multiple regions in under two years. Its early success with major European and global financial institutions demonstrates both the urgency of the problem and the scalability of its solution.

As Carlos Moreira da Silva, Managing Partner at 33N, said:

“Voluntary fraud has become one of the most damaging and underestimated challenges in today’s financial system. What impressed us about Acoru is not just their vision, but the rare combination of deep domain expertise and execution excellence of the founding team. Only an exceptional team could design a platform this comprehensive, easy to deploy, and intelligent.”

This confidence on the team’s expertise and background was one of the strong pillars that motivated us to back Acoru.

Looking ahead

The rise of AI-assisted fraud requires AI-driven defense. Acoru is building the intelligence fabric that will allow institutions to outpace attackers by predicting and preventing the next scam — before it happens. Learn more at acoru.com.

Stay tuned for more updates. Let the winds keep blowing.

33N Company Updates 🚀

DataGalaxy

Recognized in an ISG One research from Matt Aslett – Read more

Spoke at AWS GenAI Loft at StationF

Attended Big Data & AI Paris

Attended Big Data London and hosted a session with Sportradar

Spoke at Open Lakehouse + AI meetup at Forward Data Conference

Exein

Attending Embedded World North America in California, 4-6 November

Attended and spoke at Sifted Summit London

Named as a Representative Vendor in the 2025 Gartner Market Guide for Embedded Security for IoT Connectivity

Announced a partnership with Kontron Group

Attended and spoke at Electronics & Applications 2025

Invited to Bloomberg’s Daybreak Europe to discuss recent cyberattacks – watch here

Attended Gartner Security & Risk management Summit 2025

Panorays

Attending OptiveCon

Attended ISF World Congress

Attended Kodi Connect’s Cybersecurity Leadership event

Attended BlackHat USA 2025 and hosted a CEO vs CISO basketball game

StrikeReady

Attended GITEX Global and co-hosted exclusive dinner

Nominated as a Top 5 finalist for SANS Institute Difference Makers Award in Innovation of the year category

Attended FalCon 2025 by Crowdstrike

Featured in Cyber Defense Magazine’s Innovator Spotlight – Read More

Attended Blackhat USA 2025

Acoru

Announced this Series A that we just told you about!

Spoke at the II Congress of Cybersecurity and Fraud, organized by Madrid’s Custer of Cybersecurity

Upcoming Events for 33N 🤝

Cyber Innovation Day, 4-6 Nov, Washington — Gonçalo B., Gonçalo S.

Tech Tour AI & Digital Trust, 5-6 Nov, Lausanne — Christophe

Websummit, 10-13 Nov, Lisbon — Carlos A., Carlos M., Margarida, Alina, Pedro

Slush, 18-20Nov, Helsinki — Pedro, Lourenço

Black Hat MEA, 2-4 Dec, Malham — Carlos A., Carlos M.

Cyberweek, Tel-Aviv, 8-11 Dec — Eli

Black Hat Europe, London, 8-11 Dec — Gonçalo B., Gonçalo S.

Reach out to meet us there!