Cyber winds ༄༄

Apr-23

Given intense personal activity this month (just joined new fund 33N), this month’s newletter suffers from at least 1 week delay versus usual. Even so, we’re mostly up-to-date with trends this month, as April saw mostly an acceleration of previous trends.

On the public markets side, more than half of tech companies already shared their results for 1Q2023. Given tough macro-environment, as also shown by cloud hyperscalers continued growth deceleration, valuation multiples took a beating versus end March-23.

On the other hand, there seems to be a slight better of public companies to beat target consensus from market analysts versus 4Q2022, as highlighted by Jamin Ball, but it is yet soon to say the market has reached a floor and will ready for some tailwinds.

On the private funding market, the Generative AI/LLM run continued, with major rounds of OpenAI as well as LLM enablers such as vector databases (the race is on!):

Pinecone raised $100m (on a $750m valuation)

Weaviate raised $50m - congrats Bob van Luijt and team!

Qdrant raised $10m also to further develop its vector database

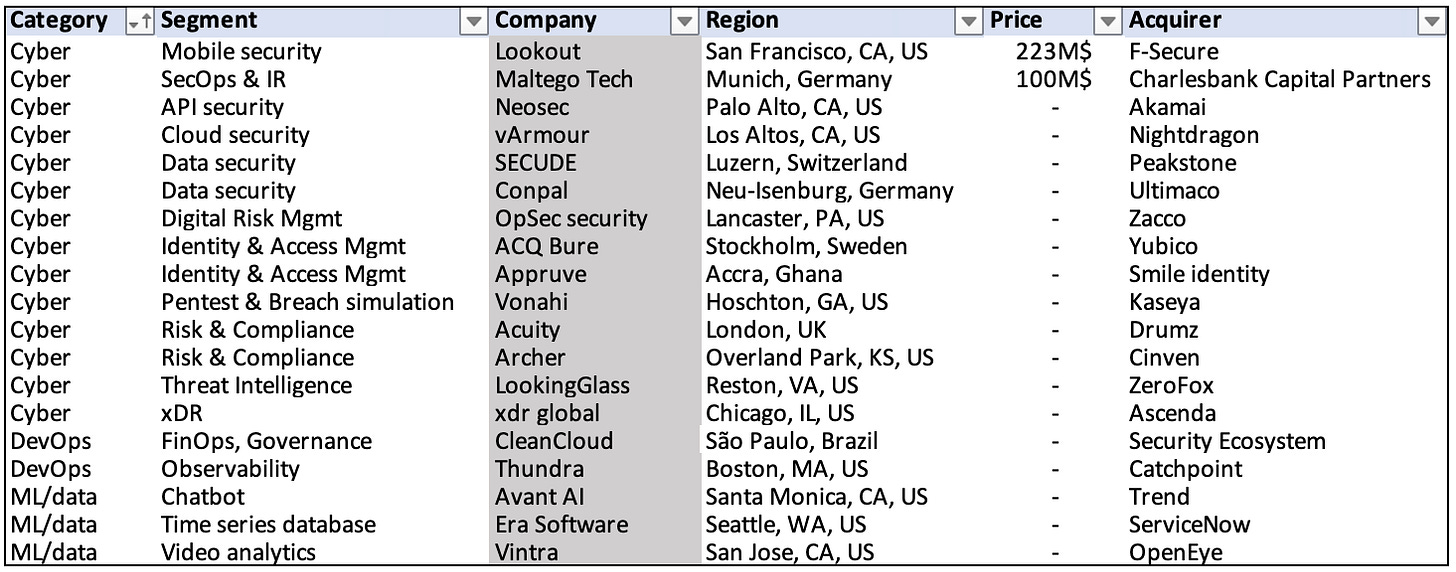

On the M&A side, a significant volume of deals in cybersecurity also points to continued consolidation, across segments (Data security, IAM, Cloud security, etc).

The winds continue to blow across cyber, DevOps and ML/Data infra. If you’re around South Summit in Madrid or Viva tech in Paris next month, give me a shout!