Cyber winds ༄༄

Jun-23

Besides a new (expected) wave of heavily funded start-ups and acquisitions across GenAI, the month of June brought also a strong wave of M&A announcements just ahead of the holiday season - a sea of sharks.

While controlled IT budgets continue to impact the industry, depressed valuations and an uncertain fundraising market create the right bait for attentive sharks. Still, especially within cybersecurity, VC investors continue to see good reasons for optimism.

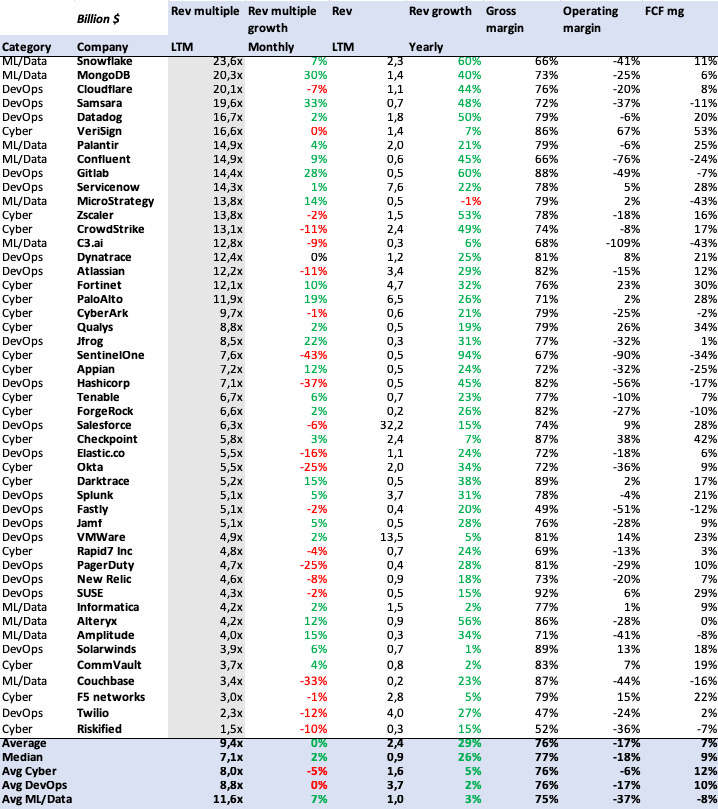

On public markets, trading multiples continued mostly unchanged. Rubrik is said to be prepping for IPO while several punters list Databricks as a top candidate for IPO this year. Databricks, together with Snowflake, continues to be a strong contender in the GenAI/LLM space as well as one of most active acquirer in the last months (acquired MosaicML, Rubicon and Okera, while Snowflake gobbled Neeva, LeapYear, Myst and Snowconvert). A public Databricks would for sure help having stronger insights on the real adoption of GenAI/LLM across large enterprise.

Within the private fundraising market, notable round announcements shook the GenAI and data security markets:

Cohere raised 270m$ at 2.1b$ to take OpenAI heads on as a reference embedded model provider of Generalist LLMs

Mistral AI raised 113m$ seed round at 260m$ valuation to build a European competitor to OpenAI

Cyera raised 100m$ to disrupt data security

In M&A, June was one of the most active months to date:

Apptio was acquired by IBM for 4.6b$, now expected to reinforce IBM’s FinOps suite (including their suites One, Cloudability, and Targetprocess – spanning from cloud cost management to process and planning optimization)

MosaicML was acquired by Databricks for 1.3b$ to add LLMOps capabilities

Mode BI acquired by Thoughspot for 200m$, bringing Generative AI capabilities to Business Intelligence analysts

BluBracket was acquired by Hashicorp, complementing Vault’s secrets management to help prevent accidental leaks and fight secret sprawl

As the holidays kicked in, it is expected a slow down in funding and M&A announcements. Most scale-ups and investors are expecting a more dynamic fundraising environment for the 2nd half of 2023. On the commercial side, vendors will for sure pay attention to Enterprise budget buffers, in a traditionally strong Q4 for enterprise software sales. Enjoy if you’re having holidays!