Cyber winds ༄༄

Mar-23

In public markets, trends continue improving, with Nasdaq up by ~15% YTD but fundamental valuation multiples mostly stable (in the 8-9x Revenues across infra software). Macro-economic challenges still loom, with several signs for caution (eg. Samsung cutting memory chip production as tech demand remains sluggish).

Besides SVB’s bank run, the main buzz for the month was still around Generative AI/LLMs, with both bullish as well as bearish sentiment. As the wave accelerates, with vertical solutions that are just now being built or announcing VC rounds, Jamin Ball delves into the economics of building over generic LLM providers (OpenAI and others).

On the data/ML infra side, Ben Lorica recently outlined the key components to train and run LLMs. VC funding is already showing for some of these, including vector databases - eg. Chroma, Weaviate and Pinecone - who have either raised rounds this month (Chroma) or have allegedly received term sheets with valuations ranging as high as $700 million.

Key announcements also included the launch of Microsoft’s security co-pilot offering, doubling down on LLMs and a consolidation play of the security stack.

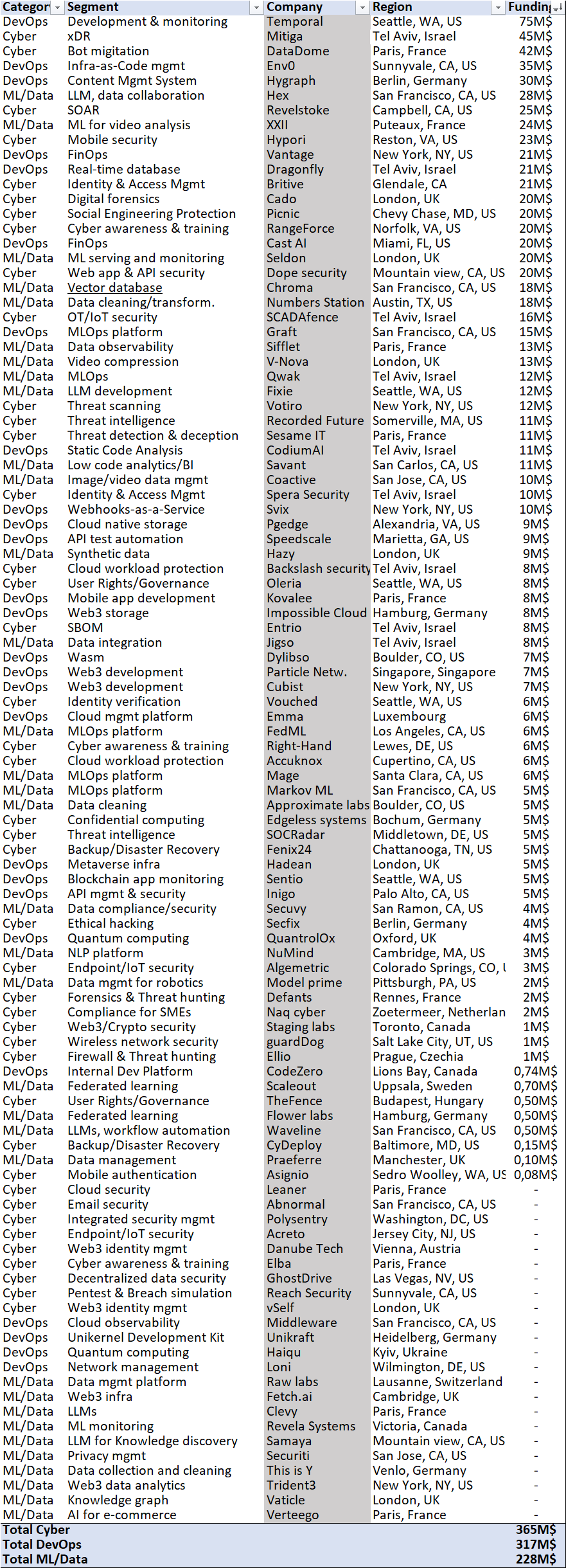

On the private funding market, March had less activity in both number and value of deals. Most notable fundraising rounds:

Env0 raised $35m to continue simplifying, securing and governing infra management with its IaC platform - congrats Omry and Ohad!

Hygraph (former GraphCMS) raised $30m for digital content management based on a composable architecture approach and GraphQL - congrats to the team and investors OnePeak partners!

Picnic raised $20m for social engineering protection - congrats to the team and investors Brightpixel! (Disclaimer I’m an investor at Brightpixel)

Seldon raised $20m to power its ML serving, monitoring and explainability platform - congrats to the Seldon team and Brightpixel! (Disclaimer I’m an investor at Brightpixel and now also part of Seldon’s Board :])

Chroma raised $18m to support the rise of developers using its vector database for Generative AI based applications

On the M&A side, a second wave of cloud security (including CNAPP, CWPP, CSPM) consolidation is expected to continue this year as per Gartner. Most notable M&A deals (potentially early examples of this consolidation):

Axis security acquired by HPE, allegedly for just under $500m, to reinforce its SASE offering; Axis was founded in 2019 and out of stealth in 2020, so likely a good exit for the founders

Lightspin acquired by Cisco, allegedly for $200-$250m, also a good exit for the founders given it was founded in early 2020

For cloud infra founders/investors/curious minds, Kubecon Europe is just around the corner, this year in Amsterdam. Give me a shout if you’re around!