Cyber and Infra post-summer trends

Cybersecurity and infrastructure software trends, supported by 33N ventures

This is a second part of our Summer reflection on the main trends in cyber and infra software, now covering infra software at seed and series A stages.

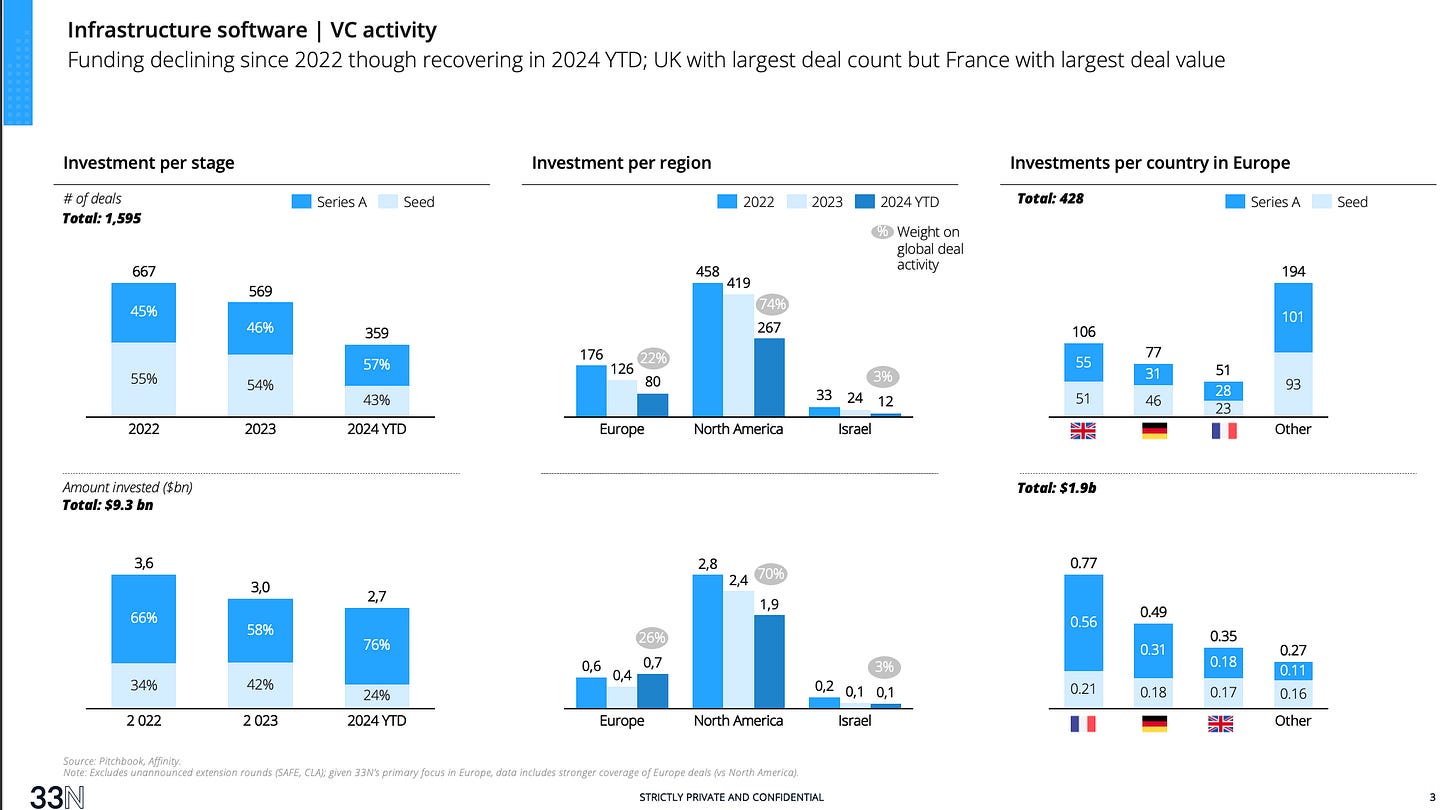

Overall, just like cyber, infrastructure software hasn’t been totally immune to the global decrease in VC funding, with a decrease in both deal volume and value in 2023. For 2024 however, investment in year to date (until August) already showed promising signs of an upward trend. Geographically, North America takes the lion share with 70-80% of deal count and value, Europe 20-25% and Israel the remaining. This data doesn’t consider unannounced extension rounds (often in the form of convertible note or SAFE) which volume is unknown and could easily correct the downward trend (our perception is that 2023 saw a lot of extensions).

On a per country perspective, while the UK continues to be the leading market in deal count, France is actually the leader in deal value, while Germany stands as the third country. Going a level below into the representative deals, it becomes clear that France’s leadership is really driven by Software development tools (think Poolside building an AI software developer) as well as AI development tools (think Mistral, Hugging Face, H company).

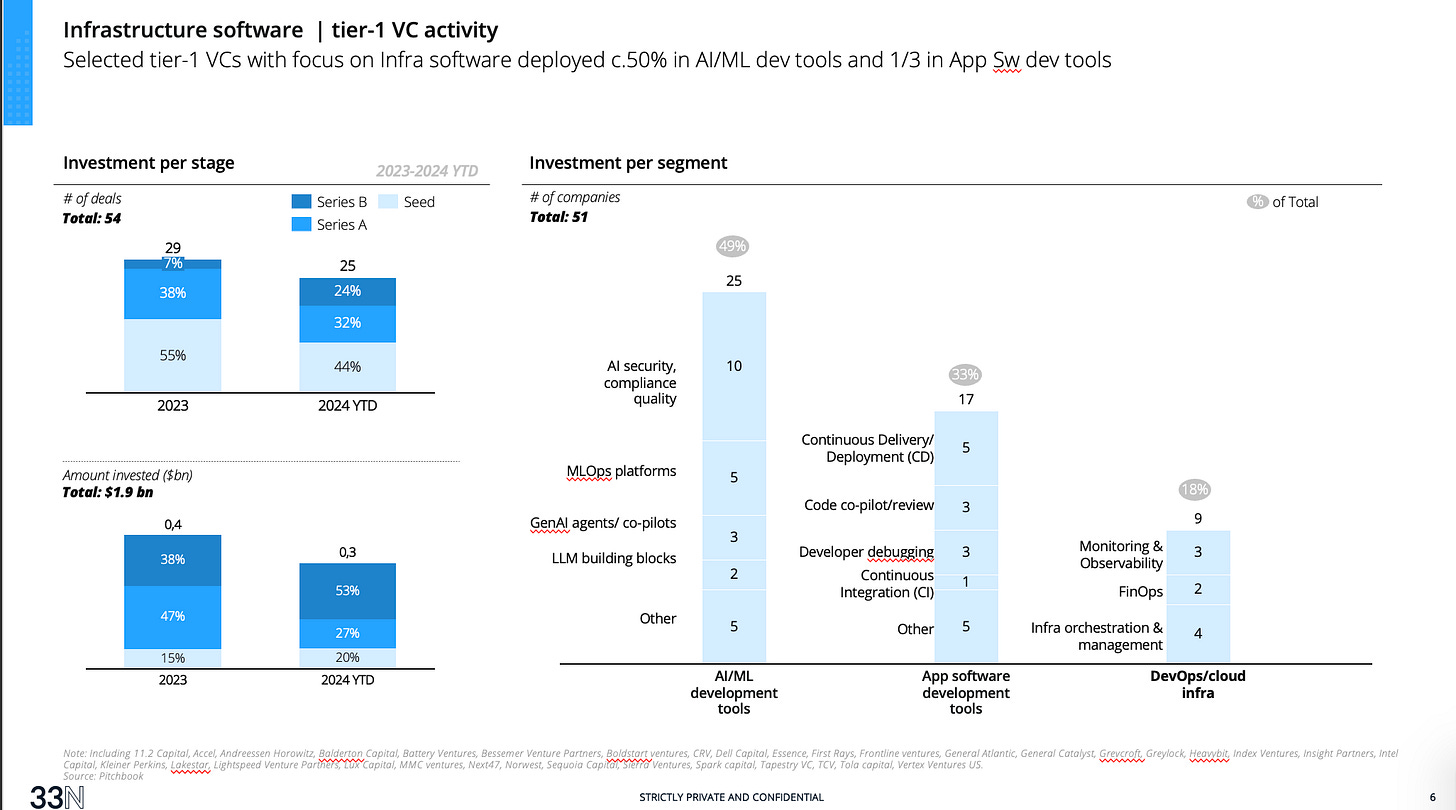

Looking into the activity of selected infrastructure software VC funds at seed, series A and B stages, deal count and value in 2024 YTD is already close to the levels of the whole year of 2023, suggesting a strong year of 2024 for specialized funds.

From a market segment perspective, c. 50% of investment volume went to AI/ML development tools, followed by App software (33%) and DevOps/Cloud infra (18%). In a sub-segment perspective:

In AI/ML, the leading category was AI security, compliance and quality, though a category with still early enterprise adoption from our perspective

In Software development tools, Continuous Delivery/Deployment (CD) and code review/co-pilots were the top categories, unsurprisingly given the significant adoption of code co-pilots and next gen PaaS/IaaS platforms.

DevOps/Cloud Infra saw overall the lowest investment, formed by broad but well established such as orchestration&management, monitoring&observability or FinOps

These trends are consistent with recent reports on Enterprise tech spending (eg. Battery’s state of enterprise tech 2Q2024); while Cloud infrastructure, GenAI/LLMs and Enterprise security are expected to take the largest share of budget in the next 12 months, the fastest growing categories are AI/ML, Data and Security, with Dev tools falling back to the 4th place.

Overall GenAI/ML continues to be the elephant in the room for early stage seed to Series B stages. While 2Q2024 saw investor concerns across public markets on an AI spending bubble, yet to be fully disproved, enterprise budget outlooks support increased enterprise demand (eg. Battery’s state of enterprise tech 2Q2024). Looking forward to seeing the next phase of enterprise adoption and increased maturity of vendors as they move to growth stage.

If you’re building in these spaces, don’t hesitate to reach-out!

33N Company Updates 🚀

Launches guide on CRA adoption, ahead of CRA’s final approval in November 2024 👉 Read more

Launches guide on security for IoT-enabled Vehicles 👉 Read more

CEO Gianni Cuozzo attending Cybertech Europe in Rome 8-9th October 2024

Partners with Onda to transform the future of cyber insurance 👉 Read more

Attending Innovate Cybersecurity’s summit in Scottsdale 6-8th October 2024 👉 Read more

Upcoming Events for 33N 🤝