Cyber winds ༄༄

Cybersecurity and infrastructure software trends, supported by 33N ventures

We’re back on track post-Summer, just to witness the same M&A consolidation trends of the 1st half of 2023, however with hope coming from the IPO and VC markets. Given the relative shorter activity during Summer, the current letter covers the quarter (Jul-Sep) but from now on we’ll get back to monthly editions.

In public markets, the last few months have shown several key trends:

The tech IPO market is re-opening after 1.5years of inactivity (one of the longest IPO dry spells in history); specifically, in recent weeks ARM, Instacart and Klaviyo priced their IPOs, which is providing an early gauge for investors on the viability of going public right now. Databricks also released key quarterly figures similar to a public company reporting (maybe a teaser for a IPO prospectus coming soon)

Significant industry consolidation in the cybersecurity market (eg. Splunk’s acquisition by Cisco, Wiz's bid for SentinelOne)

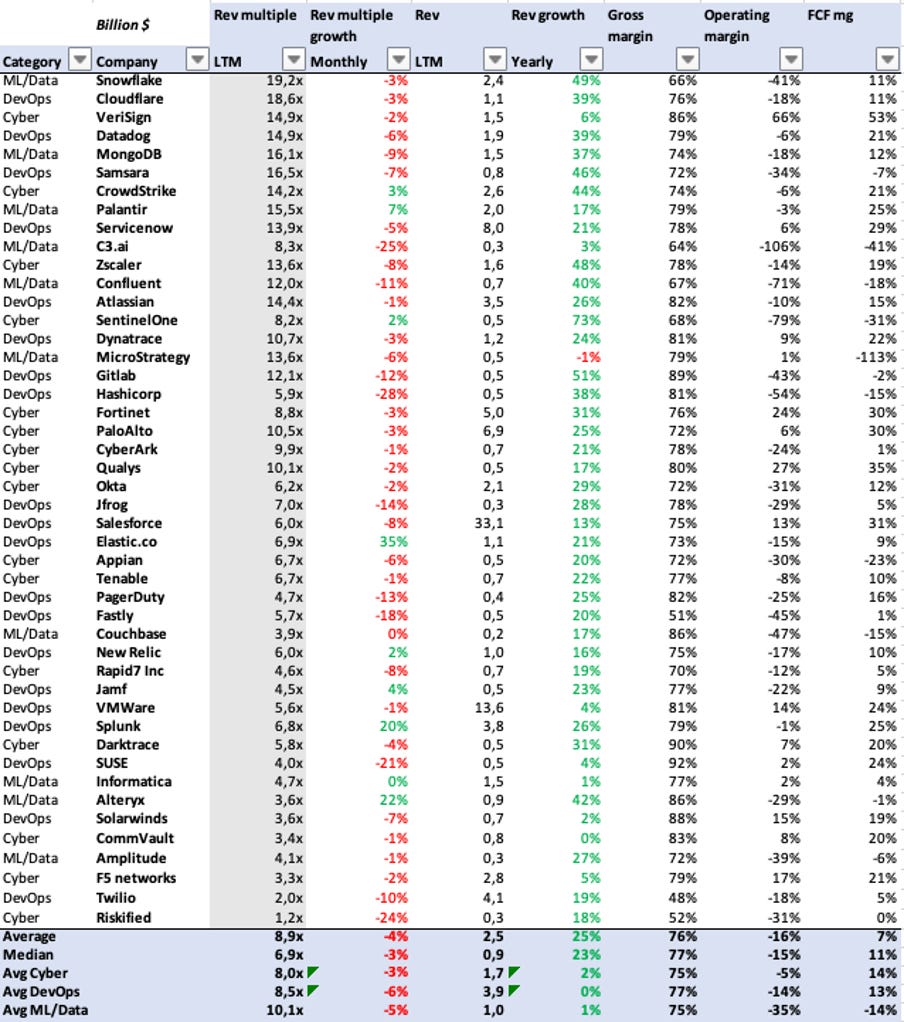

Valuation multiples corrected (see table A below, with reductions of -3% to -6% in multiples vs Aug-23) further down across the Board at the end of September (see below), driven by macro factors (eg. interest hikes, tougher enterprise sales)

A lot has been written about the rationale of the Splunk acquisition by Cisco. Frank Wang points how Splunk turns Cisco into a cyber player, Tyler Shields reckons this could be Cisco’s first step towards a broad, continuously updating contextual data set overlaid with modern AI-style query engines, giving unprecedented access to “context” around security problems.

In complement to our views, this edition inaugurates a new section where we get direct insights from tech executives and operators, this time featuring Bruno Mota and Rui Shantilal from Devoteam:

What are the main spending/concerning trends you are seeing currently across the cybersecurity and infra software market?

The continuous investment on Cloud Security; AI and Security combined efforts

What does this mean to you or your firm?

It means an opportunity as due to our multidisciplinary offers, we are able to help and support our customers on both these journeys to security and to cloud.

What is you view on the impact the Splunk acquisition by Cisco will have on the market?

It reinforces the idea that Security keeps being one of the biggest topics in the agenda and will throw other players to invest on AI enabled security.

What emerging topic are you or your firm are excited about?

AI/Gen AI

On private fundraising, large rounds were dominated by AI/ML leaders in hot segments. A relatively intense activity shows some signs of interest from VCs to return to market, where flat and downrounds still abound (anecdotal examples include Cybereason’s -88% drop in valuation or Cohere’s -65% drop). Notable round announcements:

Anthropic raises 4b$ from Amazon, heating up the race against OpenAI, while it is allegedly in talks to raise an additional 2b$ from Google and other investors

Databricks raises 500m$ at 43b$ valuation (c. 29x ARR), as they potentially show signs of preparing IPO (interesting perspective from Tom Tunguz on how they compare with Snowflake at same size)

Hugging face raises 235m$ to “double down” on its supportive efforts in many domains, including research, enterprise and startups

Aleph Alpha raises 100m$ with ambition to be the “European LLM provider”

Poolside raised 126m$ seed that will allow to start building its General AI code writing solution

HiddenLayer raises 50m$ and Protect AI raises 35m$, the two emerging front-runners in the AI security race

Finally on the M&A side, intense (shark) activity, both of sizeable as well as bolt-on acquisitions by consolidators (eg. Cisco, Checkpoint) is taking advantage of the limited money supply in the funding market. Key deals:

(Yet again) the Splunk acquisition by Cisco by 28b$ (c. 7x ARR), the single largest cybersecurity acquisition in history!

Imperva was acquired by Thales by 3.6b$, as the service provider builds its own software portfolio

As October started and expectations settle in for the Q4 of 2023 (as well as renewed expectations for the cyber&infra software budgets in 2024) a new armed conflict started between Israel and Palestine. We wish peace returns quickly and our thoughts are with the victims of these terrible events. The conflict is however likely to escalate to have repercussions in the geopolitical and macro-economic environment and particularly in the cybersecurity landscape. Let’s adjust sails again!